Home › Forums › A SECURITY AND NEWS FORUM › US dollar has proven itself

- This topic is empty.

Viewing 1 post (of 1 total)

-

AuthorPosts

-

2023-09-09 at 14:38 #419627

Nat QuinnKeymaster

Nat QuinnKeymasterThe BRICS summit has ended, and as expected, all the talk about a BRICS currency to challenge the US dollar has come to nothing.

What is usually missed from these conversations is that challenging the dominant reserve currency is not something that can be driven by governments. Only the market can do this. Despite its faults, the US dollar has proven itself against the other national currencies, including those of BRICS members.

Finance minister Enoch Godongwana understands this, and that’s why he ruled out the introduction of a BRICS currency as impractical. In theory a commodity-backed currency (perhaps linked to gold, as the US dollar was until 1971) could challenge the dollar, but this comes with logistical issues no government is equipped to solve. The governments would have to develop a system for providing final settlement in the chosen commodity (or commodities if a basket of commodities is chosen), and this wouldn’t be easy because all the important commodity markets are either in Chicago, New York or London and use USD to denominate prices.

Doing all of this would introduce costs that don’t currently exist, and while the US sanctions against Russia have spurred countries to accumulate gold reserves at the fastest pace in history, this is very different from launching a challenger to the mighty dollar. Therefore, we must look to the private sector for any signs of alternatives to the USD. It is often, if not always, the case that the private sector leads while the government follows. In particular, there has been a growth in gold and other commodity-backed stable coins like PAXG (Paxos Gold).

These stablecoins will have to prove themselves on the market over time. Do they reduce or at least keep costs at the same level as the fiat currency system that exists?

Massive advantage

Is final settlement easier or harder than what exists? Say what you want about fiat currency, but the fact that final settlement can be done electronically is a massive advantage. The only things that could compare to that are cryptocurrencies like bitcoin (not the commodity-backed stablecoins because exchanging the underlying gold still requires physical transfer of the gold).

The US dollar has a lot of legacy systems supporting it, like the massive dollar bond market (with $119 trillion of debt outstanding by some estimates) that companies and governments all over the globe can tap into. This simply means demand for dollars is guaranteed because a lot of economically important actors owe money in dollars. In fact, challenging the dollar would not even be a subject of discussion if the US government had not inflated the currency and had not weaponised it against countries like Afghanistan, Iran and Russia.

Most likely, even the BRICS members would rather be paid in US dollars than each other’s national currencies. For the foreseeable future, King Dollar will still rule. Yet it is also likely that the Americans will continue making unforced errors that undermine the dollar’s place in the world. Absent a hyperinflation (the prospects of which will be discussed shortly), even with the sanctions undermining faith in the dollar, it would still take decades to replace USD.

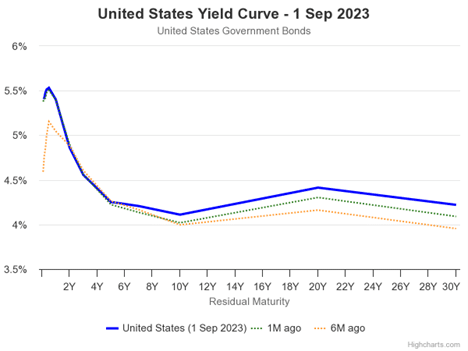

It has now been more than a year since the US bond yield curve has been inverted. A yield curve inversion means shorter-term bonds have a higher yield than longer-term bonds. In normal times, the yield curve should slope upwards with the shortest-term bonds having the lowest yields, because investors expect to be paid more for lending out their money over longer timeframes. All else being equal, you would expect one-year fixed term deposits to pay a lower interest rate than 5-year fixed term deposits. You expect to be paid more if you lend the bank your money for 5 years versus if you lend it to them for one year.

The same applies to government bonds.

The above chart was downloaded from http://www.worldgovernmentbonds.com/ and shows that yields on six-month US treasuries are higher than any other US government bond yields including 30-year bond yields. In fact, from 1 month to 3 years, the yields are higher than on bonds with longer maturities. It has been like this for most of the past year, and any time something like this has happened before, it has resulted in recession, certainly in the past 40 years. Before that, there was one exception where the GDP growth rate still declined significantly without going negative.

There are a few theories about why this inversion occurs, the most obvious being central bank actions to manipulate interest rates. Since central banks control the short end of the curve by raising short-term interest rates, they can ensure that a curve inverts if the market believes the central bank will have reason to reverse this interest rate tightening in future. Another theory is that when markets expect a recession, then riskier investments like stocks become less attractive and safer investments like bonds become more attractive, so people buy bonds depending on how long they expect the recession to last, usually longer-term bonds like the 10-year bond. This increase in demand for longer-term bonds then lowers their yield because of the inverse relationship between bond yield and bond price (the higher the price, the lower the yield).

Inflationary

Whatever the case, we know what happens when a recession occurs. Governments often feel the need to spend their way out of it. This is especially the case in the USA, where even Republicans like George W Bush and Donald Trump will increase spending significantly during recessions. Of course, this is always enabled by the US federal reserve lowering interest rates to allow the government to spend while tax revenue plummets This is an inflationary set of circumstances.

We might be living in a special time because the US economy (just like the South African economy) never really recovered from the 2008 crash. This, along with the depth (how much higher short-term yields are compared to long-term yields) and length of inversion (the yield curve typically un-inverts when the recession starts, which is usually not more than a few months after the curve first inverts, this inversion has lasted an unusually long time) as well as other factors such as the possible reversion to the mean of interest rates and inflation, means this could be a spectacular recession, possibly worse than 2008, and it will be global.

It is worth remembering that apart from the anomaly of the Covid recession, the US economy has been in a long uptrend in their business cycle since the 2008 recession, even though it has been a weak recovery. And over time, more and more has to be done to stimulate the economy. The 2000 recession was the first time the US took interest rates to zero. In 2008 taking interest rates to zero was not enough, they also had to introduce quantitative easing. All of this means nothing can be taken for granted as far as the risk of something as extreme as hyperinflation is concerned. The fact that US debt to GDP is at the highest level it has been since the end of World War II is concerning. This, apart from the weaponization of the dollar, means hedging yourself by owning some real assets like gold, real estate etc is not a bad idea.

While BRICS is unlikely to lead to the demise of the US dollar, American policymakers can do the job themselves. There comes a point where a currency is inflated so much (by creating many more currency units than can be supported by economic activity) that it becomes useless for practical purposes. Those who merely transact in the currency can always abandon it when this happens. But those whose assets, especially debt assets, are denominated in the currency are not so lucky.

This is why hedging against this scenario given the risks that prevail is sensible. The hedge doesn’t have to be crazy; most likely less than 10% of the average person’s portfolio is appropriate (discuss this with a financial advisor). But doing nothing is the worst policy.

-

AuthorPosts

Viewing 1 post (of 1 total)

- You must be logged in to reply to this topic.