Home › Forums › NATS NIBBLES › All the major companies that billionaire Johann Rupert controls by LUKE FRASER

- This topic is empty.

Viewing 1 post (of 1 total)

-

AuthorPosts

-

2025-02-06 at 18:03 #461572

Nat QuinnKeymaster

Nat QuinnKeymasterAll the major companies that billionaire Johann Rupert controls by LUKE FRASER

All the major companies that billionaire Johann Rupert controls

Johann Rupert is the richest man in South Africa, with control over three large holding companies – Richemont, Remgro and Reinet.

The latest figures from Forbes show that Rupert is worth $13.6 billion (roughly R255 billion) – making him the richest person in the country.

Rupert is the chairman of the Swiss Luxury goods firm Compagnie Financiere Richemont.

Richemont was founded by Rupert in 1988 via the spin-off of the international assets owned by Rembrandt Group Limited of South Africa, which is now known as Remgro.

Rembrandt was established by Rupert’s father Anton in the 1940s and was involved in gold, diamond, and luxury goods investments.

Rupert is also the chairman of Remgro, which primarily focuses on local investments in South Africa.

He also chairs Reinet, which is an investment holding company based in Luxembourg. Reinet previously housed Rupert’s major shareholding in British American Tobacco but has now seen a major strategic shift.

Although Rupert chairs all of these holding companies, he is still a minority shareholder in most of these organisations.

Nevertheless, he maintains control of these companies via controversial capital structures.

Richemont

Richemont is the largest company that Rupert has control over, with the Swiss Luxury brand owning jewellers Cartier, Van Cleef & Arpels, and Buccellati.

It also houses specialist watchmakers A. Lange & Söhne, Baume & Mercier, IWC Schaffhausen, Jaeger-LeCoultre, Officine Panerai, Piaget, Roger Dubuis, and Vacheron Constantin.

As per Richemont’s website, Richemont has 537,582,089 A registered shares, with a par value of CHF 1.00 each, and 537,582,089 B registered shares, with a par value of CHF 0.10 each, in issue.

The primary listing Richemont A shares are listed and traded on the SIX Swiss exchange, whereas the secondary listing Richemont A shares are listed and traded on the JSE.

Notably, the B shares are not publically listed and represent 9.1% of the equity of the Company.

The 537,582,089 Richemont B registered shares are held by Compagnie Financière Rupert, which is controlled by Rupert.

Compagnie Financière Rupert is the only significant shareholder, with 3% or more of the voting rights.

Although the 6,418,850 Richemont ‘A’ shares and 537,582,089 Richemont ‘B’ registered shares he owns represent only 10% of the equity of the company, he controls 51% of the company’s voting rights.

Thus, Richemont has a dual-class structure, with different classes of common stock outstanding having more voting powers than others.

This gives one group of shareholders, in this case Rupert, effective control of the company even though they only hold a minority share in the company.

The CFA Institute has strongly advocated against dual-class voting structures as they give disproportionate power and potentially override the interests of the majority of shareholders.

Despite the potential fears over the class structures, investors have been pilling into Richemont following its latest update.

Richemont’s market cap recently surpassed 100 billion Swiss francs (R2 trillion) for the first time amidst better-than-expected sales.

Richemont’s latest update for the quarter that ended December showed that consumers in the Americas and Europe, with Richemont’s jewellery brands faring strongly.

The results also gave a boost to the wider luxury sector on optimism that the industry is recovering after weak demand in recent years, especially in China.

Remgro

Looking at South Africa, Rupert also has large amounts of control of Remgro.

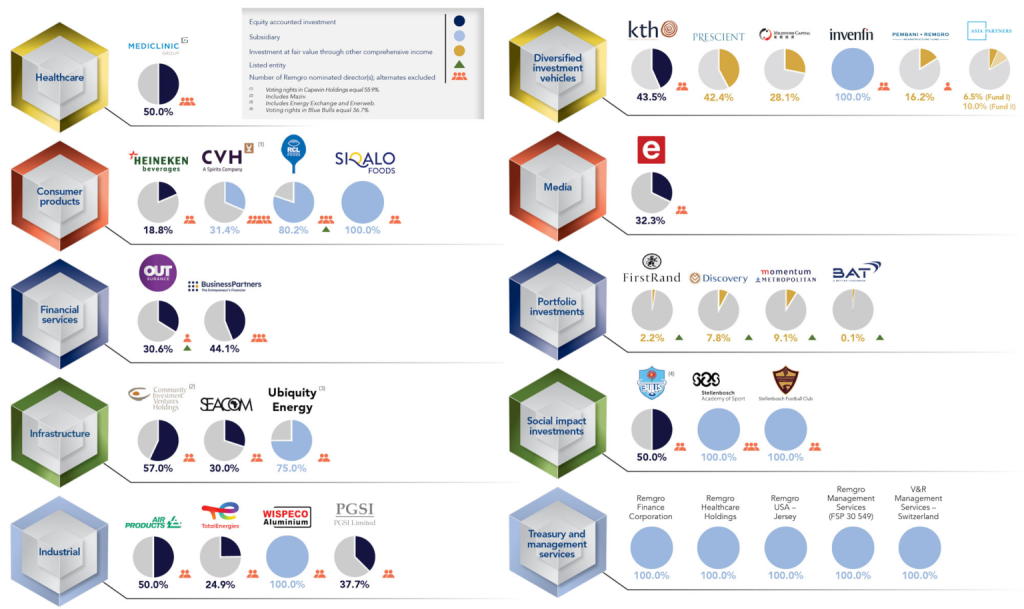

Remgro as an asset manager has large shareholdings in several prominent South African companies, including Mediclinic, OUTsurance, Season, CIVH, Heineken Beverages, FirstRand and the Blue Bulls.

As chairman, Rupert controls 7,553,865 A shares out of the total 529,217,007 shares available, representing about 1.4% of the company.

Rupert and his son Anton Rupert Jnr. also hold 7,551,005 shares in Remgro through an associate company, representing 1.4% of the company’s issued share capital.

However, like Richemont, Rupert, through Rupert Beleggings Proprietary Limited, is the only shareholder of the 39,056,987.

B ordinary shares are entitled to 43.09% of the total votes of shareholders of the company.

Combined, Rupert holds roughly 46% of Remgro. Although this is not a majority, it still gives Rupert huge control of Remgro.

Remgro had a challenging time in its latest full financial year ended on 30 June 2024, with the group’s headline earnings decreasing by 20% from R7,056 million to R5,647 million.

The group said that the challenging operating environment contributed to the loss, with Heineken Beverages contributing a R297 million loss.

The company has a market cap of R75 billion, making it the smallest of the three holding companies.

Reinet

Finally, the Anton Rupert Trust holds 48.8 million ordinary shares in Reinet Investments, which represents a 24.93% shareholding of the company’s total issued share capital.

The Ruperts also hold the 1,000 management shares issued by Reinet, which gives them broad power to manage the company as General Partners.

Reinet was often seen as Rupert’s forgotten child, with it previously holding the vast majority of his BAT shareholding.

However, earlier this year, Reintet sold its 43.3 million ordinary shares in BAT for a price of £28.20 per share to institutional investors.

This raised gross proceeds of some £1.22 billion ( about R28.3 billion).

This interest in BAT represented 24% of the net asset value of Reinet, which included roughly 48.3 million BAT shares. The other 5 million shares in BAT had already been sold by the start of the year.

Speaking with MoneywebNow, Sanlam Private Wealth Nick Kunze said that the move is interesting, as it opens a lot of cash.

As Rupert is notorious for not giving cash back to shareholders, it will likely be used to strike a deal/acquisition.

Outside of the BAT cash, Reinet’s assets include shareholdings in a majority shareholding in UK-based Pension Insurance Corporation Group and US-based Trilantic Capital Partners.

Reinet’s market cap is currently worth roughly R90 billion.

SOURCE:All the major companies that billionaire Johann Rupert controls – BusinessTech

-

AuthorPosts

Viewing 1 post (of 1 total)

- You must be logged in to reply to this topic.