Home › Forums › ⚖️ CRIME INVESTIGATION LIST ⚖️ › SA to get beneficial ownership database to fight financial crime.

- This topic is empty.

-

AuthorPosts

-

2023-03-04 at 00:22 #395903

Nat QuinnKeymaster

Nat QuinnKeymasterSA to get beneficial ownership database to fight financial crime.

The Companies and Intellectual Property Commission (CIPC) is to implement a beneficial ownership registry as part of South Africa’s efforts to counter financial crimes.

The country was placed on the Financial Action Task Force (FATF) grey list last week for not doing enough to combat crime such as money laundering, tax evasion and terrorist financing activities through the relevant legislative and prosecutorial systems.

Read: Dirty money: SA’s David and Goliath situation

The CIPC said it plans to establish a beneficial ownership (BO) register: essentially a database that will keep records and detail what entities individuals own, effectively improving transparency for law enforcement agencies and corporate vehicles operating in the country.

A beneficial owner is any natural person with a shareholding of 5% or more in any legal entity; or a person who exercises effective control of an entity.

Tackling anonymity

The establishment of an ownership database is also aimed at strengthening the ability of investigators to fight crime and corruption by criminal syndicates and lessen anonymity which may enable a range of illegal activities.

The CIPC, which administers 2.1 million active entities, currently only holds the records of legal owners and management entities in the form of members and directors.

“As it stands, no record of company shareholders and beneficial owners is recorded by the CIPC. As such, the CIPC recognises its responsibility as one of the key role players in safeguarding the integrity of our regulatory environment in South Africa and [is] integrally placed to manage the risks associated with money laundering, proliferation and terror financing activities,” the registrar of companies said on Wednesday.

Preventing abuse

CIPC Commissioner Advocate Rory Voller said the register will go a long way in preventing abuse of corporate vehicles for nefarious purposes and assist South Africa in complying with the FATF requirements.

Read:

Solutions to improve trust oversight may still be challenged [Jan 2023]

Who may access the financial statements of a private company? [Feb 2023]“With the promulgation of the applicable regulations, the CIPC will implement the BO register and support the relevant stakeholders in mitigating against deficiencies identified by the FATF, and to help expedite the country’s exit from the grey list,” he said.

The register, which forms part of newly-amended legislation, will be implemented in accordance with the commencement of the General Laws Amendment Act, which was signed into law in December 2022. While most of the sections under the bill have kicked in, some will become effective on 1 April this year.

Voller said the CIPC “will continue to work closely with other key stakeholders”, including the South African Reserve Bank and National Treasury, to strengthen its oversight of anti-money laundering and counter-terrorism financing risks in the financial sector.

As an aside, Finance Minister Enoch Godongwana sees South Africa, which has to resolve 15 areas of concern, exiting the grey list by the middle of next year. This was revealed in his interview with Moneyweb editor Ryk van Niekerk, on RSG Geldsake.

Read:

SA will be removed from grey list by mid-2024, says Godongwana

Enoch Godongwana and Hendrik du Toit talk about the FATF greylistingInvestigations ‘challenging’

The CIPC said authorities that rely on beneficial ownership information for investigations found there were “serious international challenges” in obtaining key information on companies, trusts and partnerships. This was among various issues cited as reasons for establishing the database.

It said the authorities rely primarily on obtaining beneficial ownership information from accountable institutions, but the measures in place “are not sufficient” to ensure that these institutions are able to provide “adequate, accurate, up-to-date, and verified beneficial ownership information in a timely manner”.

It said the measures in place only address the main vulnerabilities that allow abuse of legal persons and trusts for money laundering and terrorist financing to a limited extent.

It added that companies are generally abused for money laundering, and are regularly used to facilitate corruption in the awarding of government tenders and laundering the proceeds.

Read:

The implications for SA now that it’s on FATF’s grey list

SA’s greylisting: The journey to claw back credibilityThe Companies and Intellectual Property Commission (CIPC) is to implement a beneficial ownership registry as part of South Africa’s efforts to counter financial crimes.

The country was placed on the Financial Action Task Force (FATF) grey list last week for not doing enough to combat crime such as money laundering, tax evasion and terrorist financing activities through the relevant legislative and prosecutorial systems.

Read: Dirty money: SA’s David and Goliath situation

The CIPC said it plans to establish a beneficial ownership (BO) register: essentially a database that will keep records and detail what entities individuals own, effectively improving transparency for law enforcement agencies and corporate vehicles operating in the country.

A beneficial owner is any natural person with a shareholding of 5% or more in any legal entity; or a person who exercises effective control of an entity.

Tackling anonymity

The establishment of an ownership database is also aimed at strengthening the ability of investigators to fight crime and corruption by criminal syndicates and lessen anonymity which may enable a range of illegal activities.

The CIPC, which administers 2.1 million active entities, currently only holds the records of legal owners and management entities in the form of members and directors.

“As it stands, no record of company shareholders and beneficial owners is recorded by the CIPC. As such, the CIPC recognises its responsibility as one of the key role players in safeguarding the integrity of our regulatory environment in South Africa and [is] integrally placed to manage the risks associated with money laundering, proliferation and terror financing activities,” the registrar of companies said on Wednesday.

Preventing abuse

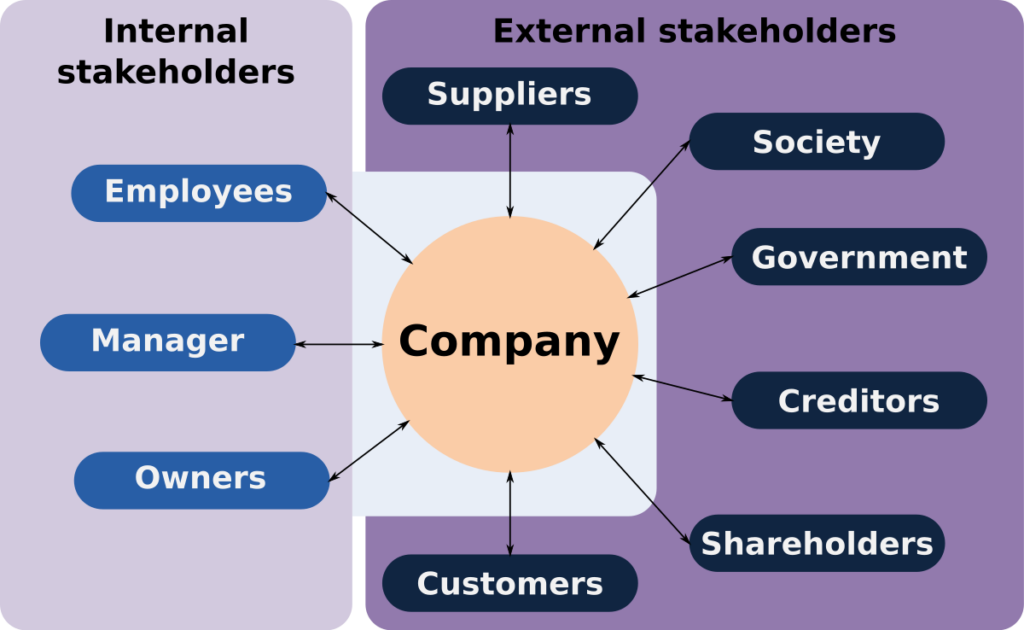

Remember SA.inc We are not a country, we are a corporation, thus there is always mentioned (Stakeholders, shareholders, investors etc.)

What happened to Fanie Fondse? the guy who challenged the Federal bank and mines?

How do these people make this much money!?? $41,265,000 = R7,505,488,651,5 in words: seventy-five billion fifty-four million eight hundred eighty-six thousand five hundred fifteen Rand

I’ll tel you how he does it: Financial fraud, he is what we consider a high profile criminal. My guess is he not only laundered money but also manipulated and forged figures

The average farm land owner…. if he owns at avg a 1000 hectare, and if 1ha = R 10,989.00

so R 10,989.00 x 1000 = R 10,989,000 (11mil) say… now how the fuck did Alan Pullinger get to 75 billion??Are you telling me Allan Paullinger’s total networth is more than any of these national budgets?

-

AuthorPosts

- You must be logged in to reply to this topic.